Read the full story

Foundation brings unique insights on business, building product, driving growth, and accelerating your career — from CEOs, founders and insiders.

What Does Good Look Like?

Great companies put 3 things together: growth, engagement, and profit.

In early 2022, when we began transforming Albert, the banking app I run, from burning cash to profitable growth, we started by defining metrics that make a great software business. For the prior five years, we hadn't built a great business; we had only built a fast growing one.

Cheap capital clouded judgment, convincing operators and investors that companies could be worth 30 times revenue, that gross profit margin and cash flow margin should not affect valuation, that it's sensible to spend 40% of revenue on people, and more.

To build a great business, we had to forget lessons learned. We had to channel our inner Charlie Munger.

This post is the third in a series of posts on how to transform a fast-growing, money-losing company into a profitable one, without sacrificing growth.

Five metrics

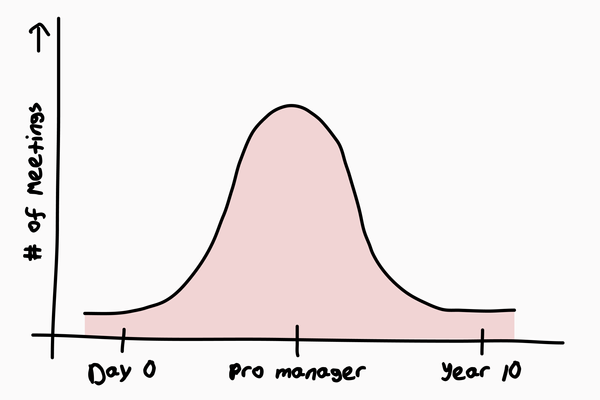

When interest rates were low, growth came at the expense of sound business.

For the first six years at Albert, we ran a business solely optimized for growth. Our peers followed a similar path: grow, raise money, repeat. When interest rates rose, the model broke because capital was no longer willing to fund expensive, unsustainable growth.

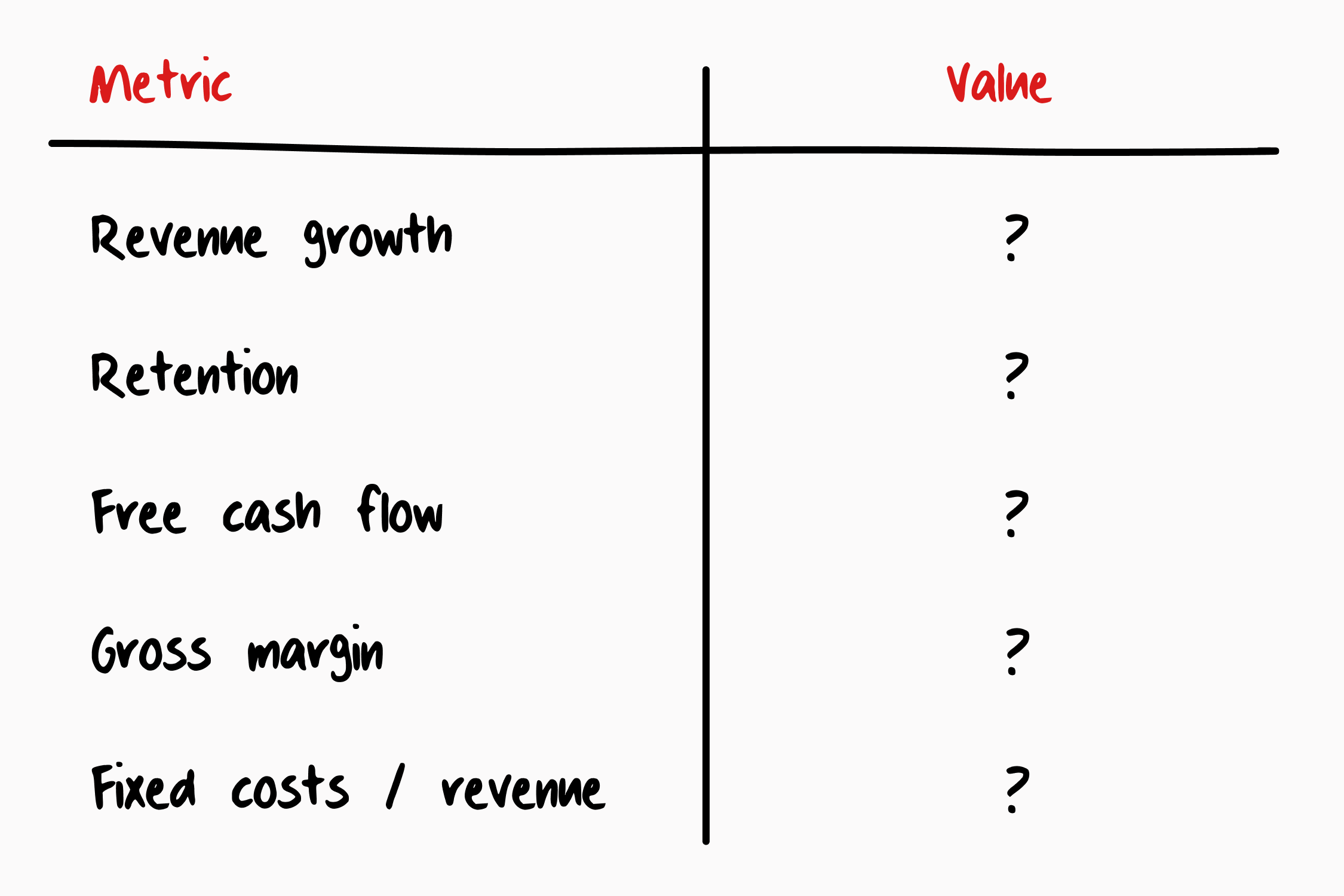

The first step to transforming Albert was defining the most important financial metrics to optimize for. We agreed on five:

- Revenue growth

- Retention

- Free cash flow

- Gross margin

- Fixed costs / revenue

Then we assessed our current state: revenue growth and retention were good, gross margin weak, and fixed costs and free cash flow awful. The second step was deciding on what good looks like—specifically, what number to target for each metric. To do this, we searched for a company to model Albert after. This would be our north star.

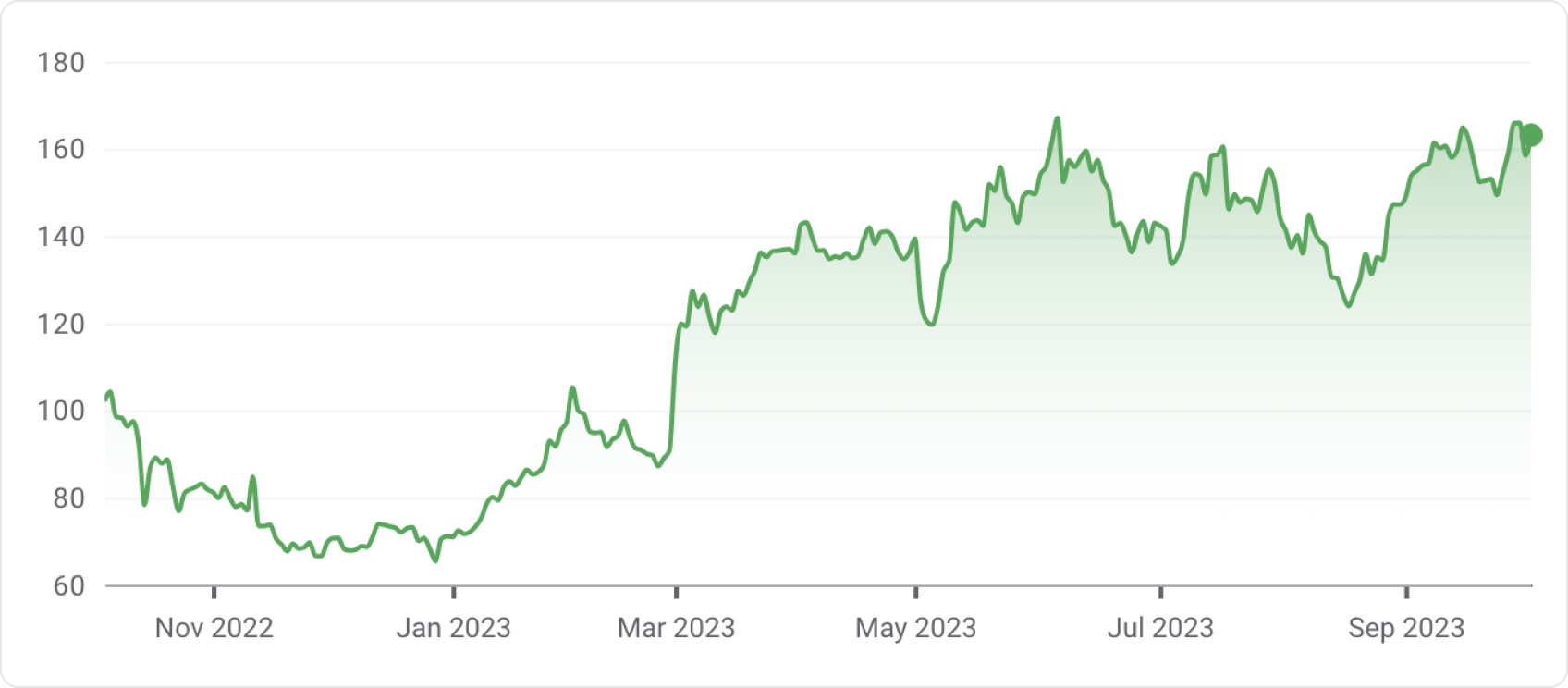

Stock price performance of Albert’s north star

North star

To model Albert's future, we looked for a consumer company with a great product and great metrics.

We found our north star in Duolingo. Duolingo is a global app that teaches anyone any language with simple, fun lessons. It launched in 2012, has millions of paying subscribers, and is now a public company.

Here's how Albert compared to Duolingo in early 2022:

Metric | Duolingo full year 2022 | Albert Q1 2022 |

Revenue growth (y/y) | 49% | 110% |

Gross margin | 73% | 51% |

Fixed costs (G&A) / revenue | 32% | 66% |

Free cash flow margin | 12% | -109% |

Albert's financial metrics embodied the era: growth at all costs. We built fast growth at scale while spending money beyond our means. For every $1 of revenue we made, we spent more than $2! In contrast, Duolingo's financial metrics were stellar, and public market investors noticed.

Duolingo enterprise value / run-rate gross profit

Duolingo's valuation multiple, already higher than other consumer companies, expanded. The company coupled a product customers love with a rare financial trifecta: high growth, high margins, and free cash flow. The more time spent analyzing Duolingo, the stronger our conviction to match Duolingo's financial metrics.

Albert's transformation

Metric | Albert Q1 2022 | Albert today |

Revenue growth (y/y) | 110% | 65% |

Gross margin | 51% | 70% |

Fixed costs (G&A) / revenue | 66% | 27% |

Free cash flow margin | -109% | 10% |

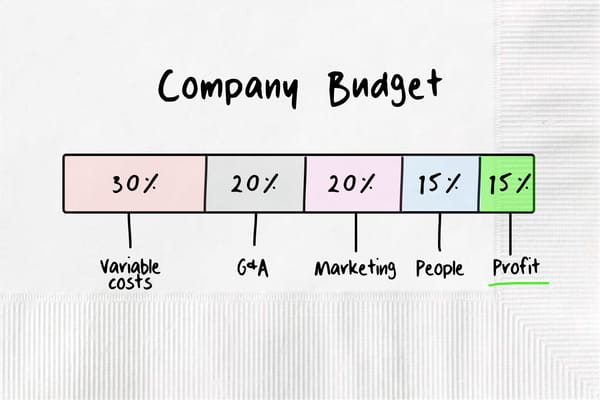

At the beginning of 2022, Duolingo's metrics seemed impossible to reach. We divided our effort into three areas:

- Grow revenue with less money. We tried to grow revenue while cutting marketing spend in half. We achieved this with many product updates and experiments. This is possible when customers love a product, and when a company's leadership is intimately involved in building product.

- Lower variable costs. We set a goal of increasing gross margin by 1 percentage point every month. We ended up averaging about 1.5 percentage points a month, reaching our gross margin goal in twelve months.

Each month we found an expensive, recurring, variable expense and tried to lower it. Fraud on debit card spend, high cost vendors, overused third party software, credit losses, excess hiring in customer support, cohorts of subscribers using the app for free, and more. - Lower fixed costs. We did a one-time purge of fixed costs using our three financial hygiene tools. Then we simply kept the total dollar amount of fixed costs flat going forward. Fixed costs, including all salaries, were roughly the same in July 2022 as they were in July 2023. Revenue doubled, so G&A margin halved.

We sacrificed unsustainable growth for a healthy business, still growing quickly. Albert became profitable by the end of 2022.

Move goal posts

Dell's salaries were 10% of gross profit in its first quarter of operation.

Examine Dell's first financial statement below. The company produces 15% income margin in its first quarter ever. The financial discipline is striking: almost no fixed costs. It's hard to imagine a financial statement like this for a startup today.

But why should a startup lose money? Is being marginally profitable sufficient? Is it reasonable for a company to spend a quarter of revenue on salaries?

Read the full story

Foundation brings unique insights on business, building product, driving growth, and accelerating your career — from CEOs, founders and insiders.